What is Pax Gold?

PAX Gold (PAXG) is a digital asset where one token is backed by one fine troy ounce of gold stored in LBMA vaults in London. PAXG can be purchased with or redeemed 1-to-1 for loco London gold. PAXG offers investors a lowered trade entry bar by allowing investment into physical gold using fractional amounts through a digital form of the underlying asset. PAXG pricing reflects that of the underlying XAU spot price against USD in real-time.

Multiple factors, including supply and demand, geopolitical events, inflation, interest rates, and the strength of the U.S. dollar can impact gold prices. Some investors see gold as a hedge against inflation and may turn to it as a store of value, while others may flock to gold at times of risk.

US Economy Status

Over the past few weeks, U.S. data have reflected higher inflation, a robust job market, a low unemployment rate, and sustained economic growth. In March, USCPI Y/Y rose by 3.47% compared to 3.15% in February, and core CPI M/M rose by 0.4%, same as in February; the job market continued to beat expectations; non-farm payroll printed 303K jobs for March compared to 270K in February, US Core Retail sales M/M were up by 1.1% percent compared to 0.6% prior (revised from 0.3%).

Looking ahead in time, the market is eagerly anticipating the release of the FED’s preferred inflation indicator, the Core Personal Consumption Expenditure price index, scheduled for Friday, April 26th, 2024. This index, which has declined since its peak in 2021, recorded a Y/Y reading of 2.4%, which is relatively close to the Fed's target of 2% inflation.

Fed officials continued to reiterate that they can be patient and there is no urgency to begin cutting rates; the Fed still sees higher inflation in the Shelter (Rent) and the services sectors of the economy and needs to see a sustained decline in inflation before any rate cut decisions. Although core PCE is approaching the 2% Fed’s target, and the Fed has previously said that they may act even before inflation hits 2%, the Fed may need to see an uptick in unemployment and/or further decline in sticky inflation components before taking any interest rate cut action.

Learn more on US Monetary Policy.

The US economic data has had a profound collective impact, prompting market participants to revise their expectations for interest rate cuts in 2024. According to the most recent update for the CME FedWatch Tool, the expectations for a 25 basis point rate cut dropped from 60% to 16.4% for the June 12th, 2024, FOMC meeting and from 50% to 37.1% for the July 31st, 2024, meeting.

Gold prices have climbed since the Fed began raising interest rates in the second quarter of 2022, with current geopolitical events also contributing to the rise. Currently, gold trades below highs made in early April, at roughly ~$2430 per troy ounce.

Technical Analysis - XAU/USD Daily Chart

Price action broke out and closed above a narrowing formation marked by the green lines in early March 2024. It has been trading above its moving average since it broke out.

Price action broke above multiple resistance levels and is currently trading near its standard calculation monthly resistance R2, which is $2366.74 an ounce.

Price action is currently trading in a range supported by annual broken resistance turn support of $2349.85 an ounce and last week's close price of $2380.00.

The MACD line coils with its signal line and attempts to break below.

The RSI and stochastic indicators reflect negative divergence with price action for the latter part of the uptrend, similar to the Commitment of Traders Report (COT).

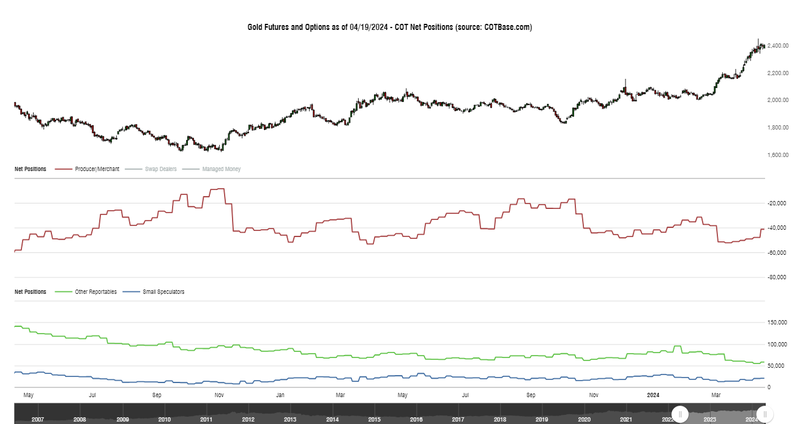

Gold Futures COT Report Update

According to the latest commitment of traders report released on April 12th, 2024, including data up to Tuesday, April 9th, 2024, the Producer/Merchant category position level is at the two-year short extreme. It also reflects a negative diversion as prices rise while producers (hedgers) buy for the latter part of the uptrend.

The same COT report also reflects a negative divergence between price action and volume as volume declined throughout the later part of the uptrend. Although higher than prior expirations, Open Interest has been either flat or declining; the overall context reflects that the most recent upside move may not be fully supported, according to the report. Higher than average volume can also be seen in a recent bearish candle, as marked on the above chart.

Trade crypto and more on our platform

Considering PAX Gold as an alternative to trading spot gold?

Through OANDA's partnership with Paxos, you can conveniently spot trade cryptocurrencies such as PAX Gold on Paxos's itBit exchange through our OANDA app.

Disclaimer

PAX Gold (PAXG) is a digital asset offering that was created and is issued by Paxos Trust Company (Paxos). Paxos charges markups and fees on each PAXG transaction. OANDA provides customers access to digital asset and virtual currency trading through its partnership with Paxos.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.

Footnotes

PAXOS, https://paxos.com/paxgold/