Is inflation good or bad? Who can benefit from it and how?

Curious about the economic buzzword that everyone seems to be talking about? Inflation - it's a term that has been thrown around a lot of late, but do you really know what it means and how it impacts your life? Today, we're diving into the world of inflation to uncover its mysteries and explore whether it's a friend or foe in our financial landscape. So buckle up and get ready for an insightful journey into the realm of rising prices and shifting economies!

What is inflation?

Inflation is like the silent ninja of the financial world, sneaking in and subtly affecting everything from the price of your morning coffee to the cost of a new car. Every time the price of that morning coffee increases, that is inflation at work. Simply put, inflation refers to the general increase in prices over time. When inflation rears its head, your hard-earned money may not stretch as far as it used to.

Inflation affects everyone, from individuals to large corporations. It is a reflection of the purchasing power of a nation's currency. It is typically measured by indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI). This is the reason why central banks keep a close eye on inflation rates because they impact economic stability and purchasing power.

While some level of inflation is considered normal and even necessary for a growing economy, excessive inflation can lead to decreased consumer confidence, reduced savings value, and overall economic instability. In fact, the impact of inflation depends greatly on various social and economic contexts. This complexity warrants a nuanced discussion on whether inflation is inherently good or bad, who benefits from it, and how individuals and businesses can navigate it to their advantage.

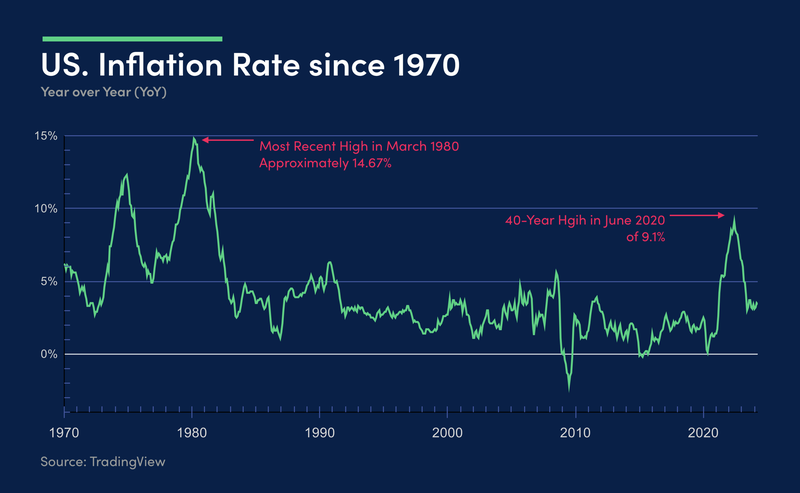

The example below is a representation of the historic Inflation rate in the United States, dating back to around 1971. The highest inflation rate on record for the US actually occurred in June 1920, when the year-on-year Consumer Price Index (CPI) inflation rate reached approximately 23.7%. This period of high inflation followed World War I and was characterized by significant economic disruptions and supply shortages.

US Historical Inflation Data

In the chart above, “the highest rate of inflation was in March 1980, coming in at approximately 14.76%. The June 2022 high of 9.1% was the highest in 40 years.”

In 2009, the consequences of the global economic downturn, housing crisis, high unemployment, and monetary policy decisions all led to a brief period of deflation, with the Consumer Price Index (CPI) dropping to -2.1% year-on-year. Throughout its history, the US has faced instances of negative inflation, but sustained deflation has generally been uncommon.

What Causes Inflation?

Inflation is a complicated topic and is usually painted in a negative light. Hence, it is important to note that inflation is a natural outcome of economic growth and increased demand.

1. Demand-Pull Inflation

One primary cause of inflation is demand-pull inflation. This occurs when aggregate demand in an economy outpaces aggregate supply. Essentially, when consumers and businesses have more money and confidence, they spend more, driving up the prices of goods and services. This surge in demand can stretch the supply chain, leading to higher costs and, consequently, higher prices.

2. Cost-Push Inflation

Another key driver is cost-push inflation, which happens when the costs of production increase. Factors such as rising wages, higher raw material costs, and supply chain disruptions can lead to this type of inflation. When producers face higher costs, they often pass these on to consumers in the form of higher prices.

3. Central Banks

Additionally, inflation can be influenced by monetary policy. Central banks, such as the Federal Reserve, control the money supply in an economy. When a central bank increases the money supply, typically through lower interest rates or quantitative easing, it can lead to higher inflation. More money in the economy means more spending, which can drive up prices.

4. Built-In or Wage Price Inflation

Lastly, inflation can result from built-in expectations, “otherwise known as wage price inflation”. If businesses and workers expect prices to rise in the future, businesses may increase prices preemptively, and workers may demand higher wages to keep up with expected inflation. This can create a self-fulfilling cycle of rising prices and wages.

5. Post-Pandemic Inflation Dynamics

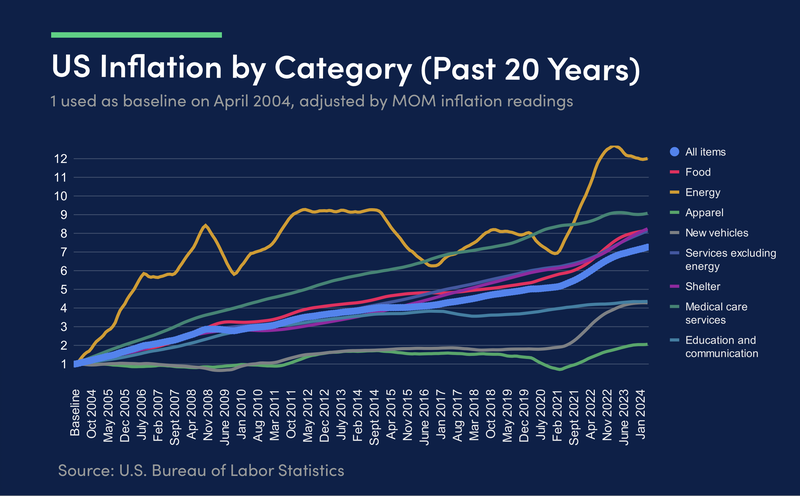

The majority of the world struggled post-pandemic with runaway inflation, and the US was no different. The chart below shows what can happen when a combination of the factors mentioned above takes place simultaneously. The chart below shows the rise in prices in the US between October 2020 and October 2021.

Why might inflation be bad?

Inflation can be a double-edged sword, with its negative effects hitting different groups in various ways. Here are some of the key ways inflation can adversely affect individuals, businesses, and the overall economy:

1. Uncertainty and Instability

Excessive inflation or hyperinflation can cause economic unpredictability and instability. This may make it difficult for businesses to plan their budgets and investments, as the cost of supplies and wages can vary unexpectedly. As a result, this uncertainty can discourage business investments, leading to a negative impact on economic growth.

2. Income Inequality

Inflation can worsen income inequality. As the cost of necessities rises, lower-income households struggle more since they must spend a larger portion of their income on essential items. On the other hand, wealthier households have more leeway financially and can manage price increases better.

3. Eroding Purchasing Power

One of the most glaring adverse effects of inflation is the erosion of purchasing power. When prices rise, consumers find that their money doesn't stretch as far as it used to, which can lead to a decrease in the standard of living. For people on fixed incomes, such as retirees, this can be particularly devastating.

Why Inflation Might Be Good

Now, being such a nuanced topic it is only fitting that we take a look at the positives regarding inflation as well:

1. Debt Relief

For debtors, inflation can act as a form of relief. When money loses value over time, the real value of outstanding debt decreases. This makes it easier for borrowers to repay loans, such as mortgages, with money that's worth less than when they originally borrowed it. This can stimulate economic activity by encouraging borrowing and spending.

2. Wage Growth

A moderate level of inflation is often associated with wage growth. When prices rise, employers may increase wages to help employees cope with higher living costs. This can create a cycle of increased spending, which further fuels economic growth.

3. Investment Incentives

Inflation can also encourage investment. When money loses value over time, holding cash becomes less attractive. This can push individuals and businesses to invest in assets like stocks, real estate, or commodities, which typically provide better returns than cash holdings. Increased investment can spur economic development and innovation.

Who Benefits from Inflation?

Navigating inflation effectively involves strategic investments that can preserve and potentially grow your wealth despite rising prices. Here are some of the most effective ways to benefit from inflation:

1. Borrowers

Borrowers stand to benefit from inflation. The value of their debt effectively decreases over time, making it easier to repay loans. This is particularly beneficial for governments and businesses that have taken on substantial debt for things like building infrastructure or funding research.

2. Real Estate Investors

Real estate tends to go up in value over time, offering protection against inflation. Property owners benefit from higher property values and can charge more rent, leading to better returns compared to other investments.

3. Businesses with Pricing Power

Companies that have significant control over their prices can pass on increased costs to consumers without sacrificing demand. These businesses can maintain or even improve their profit margins during periods of inflation. We saw this with several companies benefitting a great deal from the high inflation environment that followed the COVID-19 pandemic.

Broaden Your Knowledge of Forex Trading

Broaden your fundamental knowledge and deepen your understanding of forex trading: apply for a demo with OANDA to start your journey now.

Ways to Benefit from Inflation?

1. Currency Depreciation

Looking at ways to protect yourself against inflation from a forex perspective is interesting. It is not the most straightforward method but definitely a rewarding one when executed correctly.

As we have discussed, a high inflation rate typically leads to a weaker national currency. Thus during such periods, market participants may look to short the currency of the country experiencing high or ‘runaway’ inflation against a country which is not experiencing runaway inflation.

Alternatively, when a country’s inflation rate rises there is also the possibility that the currency may gain against its counterparts. This is largely down to market participants increasing the probability of interest rate hikes to combat inflation which in theory would also strengthen the currency. As I mentioned earlier, this is a complicated concept but once understood could prove to be a useful tool for market participants.

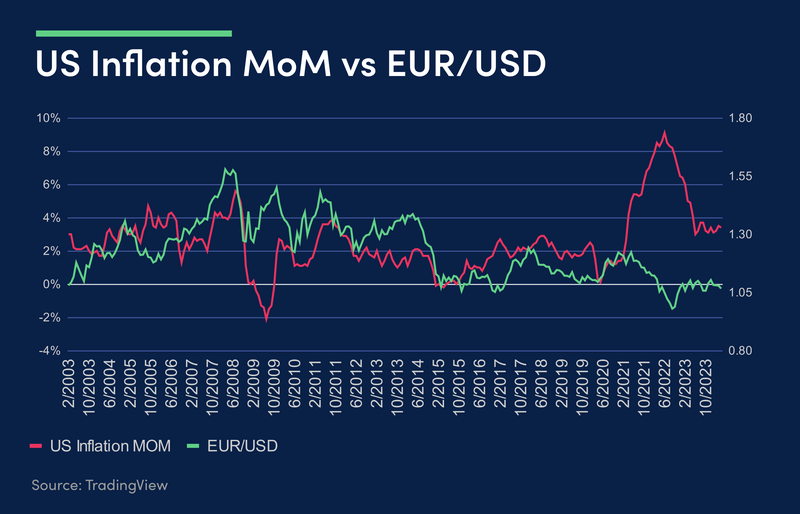

It is important to note that there is a lag effect between a high inflation environment and a country's currency experiencing weakness or strength (depending on the phase of the inflation cycle). Below I have a “EUR/USD” vs US Inflation Rate on a line chart which I believe provides an apt example as to the effects on two currencies experiencing differing inflationary statistics.

As US inflation rose significantly, Euro Area inflation did not rise at the same pace. This discrepancy saw the US Dollar gain ground against the Euro each time US inflation spiked higher. This is an example of interest rate hike expectations increasing, adding a bit of strength to the US Dollar. It is also clear that each time the US inflation rate fell, “EUR/USD” rose as the Euro gained ground against the Greenback.

US Inflation Rate vs “EUR/USD”

Consider Real Tangible Assets

Real assets like real estate, commodities, and precious metals generally retain or increase their value during inflationary periods. These types of assets can help protect one's wealth from the eroding effects of inflation.

Explore Inflation-Indexed Bonds

Governments often issue bonds that are indexed to inflation, such as Treasury Inflation-Protected Securities (TIPS) in the United States. These bonds adjust their payouts to match price rises, helping to maintain the purchasing power over time.

Diversify Financial Holdings

Diversifying financial holdings across various asset classes, sectors, and geographies can help mitigate the risks of inflation. This approach can reduce exposure to inflation-related volatility.

Monitor Growth Companies

Companies that are expected to grow rapidly often have pricing power and can pass increased costs onto consumers more effectively. Focusing on growth companies may be beneficial during inflationary periods, as these companies might see their revenues and profits increase.

Reevaluate Debt Strategies

Managing low-interest debt can be strategic during periods of moderate inflation. Since the real value of debt decreases over time, borrowing at a low fixed interest rate can be advantageous. However, it's essential to avoid high-interest debt, which can become burdensome if inflation rates spike unexpectedly.

An Interesting Time to Trade

The anticipation around monetary policy in 2024 has kept volatility relatively high in financial markets, and traders can use a variety of powerful technical analysis and risk management tools accessible on our OANDA Trade platform to find and manage opportunities quickly and effectively.

Apply for a demo with OANDA and start your journey now.

Frequently Asked Questions

Why does inflation suddenly reappear?

Inflation can come back quickly due to things like supply problems, higher demand from shoppers, or changes in government monetary policies. Other reasons may include global events as well as an increase in raw materials and production costs.

Which businesses and industries gain from inflation?

Some industries, like those dealing with raw materials, real estate, and utilities, often do well during inflation because they can pass on increased costs to customers.

Why has inflation gone up recently?

Recent increases in inflation can be blamed on concern around global events as well as differences in demand and supply. Having made significant strides since June 2022, the US still faces a challenge in getting inflation under the 2% target range.

Is this post-Covid-19 pandemic inflation temporary or will it last longer?

People are wondering whether the current rise in prices is just short-term or if it will stick around for a while. This is a good question and at present it is nearly impossible to know. Geopolitical risk increasing is one thing that could push inflation higher once more. There is also the probability that inflation will remain above the 3% over the medium term as some of the price increases post-pandemic are now entrenched in the economy.

How does the Consumer Price Index (CPI) track inflation?

The CPI measures inflation by looking at how much prices change over time for a typical basket of goods and services that urban consumers buy.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.